Turkish lira falls further in post-election turmoil; jobs data in focus

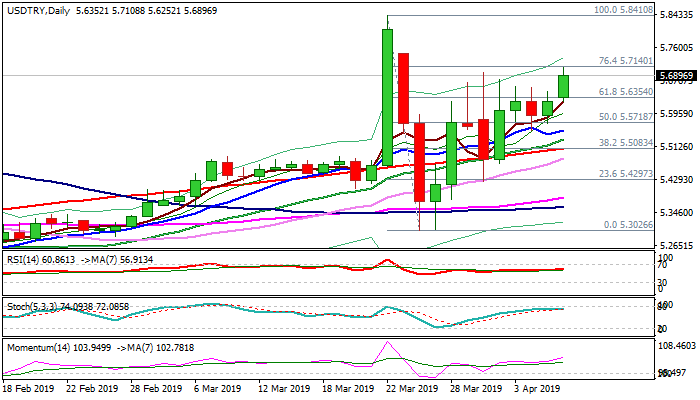

The USDTRY rallied on Monday too new two-week high, signaling eventual break above strong Fibo barrier at 5.6354 (61.8% of 5.8410/5.3026), below which the action was congested for over one week, unable to clearly break higher, despite strong upticks.

Fresh lira’s weakness comes under fresh pressure after President Erdogan showed strong doubts about election results in Istanbul (where the opposition won majority) and requested full recount of votes in this town.

Another hit to lira came from announcement of Erdogan’s plans to discuss with Russia possible Turkish military operations in Syria.

Turkish jobs data will be released on 15 Apr and market eyes results which are expected to show downbeat results (previous release showed jobless at 13.5%, the highest since global financial crisis)

Another weak result could signal Turkey’s recession, as CBRT’s ultra-tight policy is not boosting lira but pressuring the economy.

Eventual close above 5.6354 Fibo barrier would generate strong bullish signal for extension of rally from 5.3026 (26 Mar) which would look for retest of key 5.8410 high (22 Mar) and attack at 5.8868 (Fibo 38.2% of 7.1074/5.1323 fall).

Res: 5.7140; 5.7460; 5.8410; 5.8732

Sup: 5.6625; 5.6354; 5.5718; 5.5535