Turkish lira is taking a breather above new record low after a massive post-CBRT fall last week

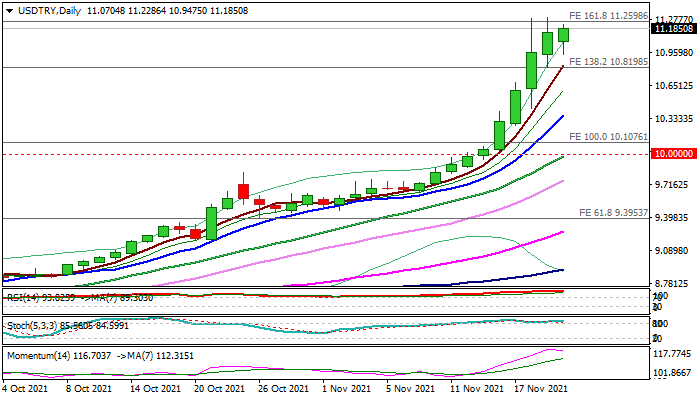

The USDTRY is consolidating under new all-time high (11.2961) but holding firm bullish tone as lira’s attempts to regain ground were short-lived.

The greenback remains well supported by risk aversion and rising hopes that the Fed may accelerate tapering pace that would lead towards earlier than expected rate hike, adding pressure on lira, already weighed down by last week’s 1% rate cut (despite the inflation is near 20%) and Turkey’s consumer confidence at the record low.

The pair advanced nearly 12% last week (the biggest weekly advance since early Aug 2018), with unexpectedly quick and easy break of psychological 10 barrier, adding to strong bullish stance.

Overbought conditions on larger timeframes suggest that consolidation may extend before bulls resume, as technical studies remain firmly bullish, while fundamentals are extremely negative.

The uptrend is currently riding on the third wave of five-wave sequence from 6.8951 (Feb 16 low) and cracked its FE 161.8% (11.2598), with sustained break here to open way towards FE200% and 238.2% (11.9721/12.6843 respectively).

Dips are expected to be shallow and offer better opportunities to re-join strong bullish market, with rising 10DMA (10.3684) to contain extended downticks.

Only return below psychological 10 support would sideline larger bulls.

Res: 11.2598; 11.2967; 11.5000; 12.0000

Sup: 11.0000; 10.9475; 10.8206; 10.5000