Turkish lira rises to five-month high vs dollar on break of key barriers and upbeat data

The Turkish lira is among top gainers on Monday, advancing 1.6% against the US dollar since opening in Asia and on track for further advance.

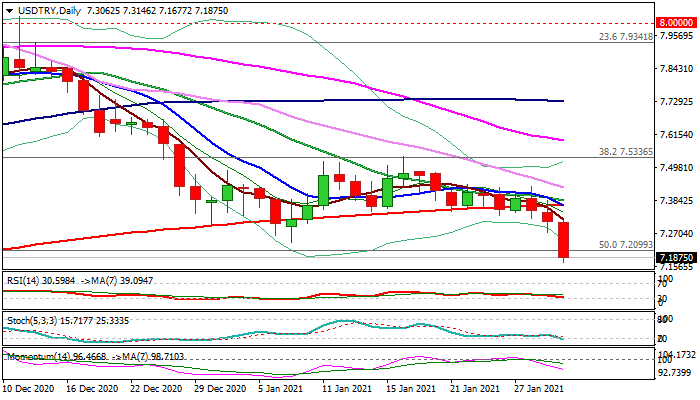

Last week’s break of pivotal 200DMA generated positive signal, with fresh acceleration through next key obstacles at 7.2370 (lira’s 2021 high) and 7.2100 (50% retracement of 2020 5.8382/8.5816 rally) on Monday, confirming bullish signal and opening way for fresh acceleration.

Lira became attractive to investors due to low cost and high yields with risk still being lower than in other assets.

Fresh rally was sparked by upbeat Turkey’s Manufacturing PMI which rose to 54.4 in January, from 50.8 in December and hit the highest since July 2020, showing that manufacturing sector growth remains resilient despite latest lockdown.

Lira rose to the highest since early August and the top of recovery from currency’s all-time low at 8.5816 (posted on Nov 16), ending third straight bullish month.

Bulls need close above broken levels at 7.2370/7.2100 to confirm bullish stance and focus targets at 7.00 (psychological) and 6.91 (weekly cloud top).

Res: 7.2099; 7.2370; 7.3146; 7.3663

Sup: 7.1677; 7.1116; 7.0000; 6.9100