Turkish lira shows scope for further advance and test of key 200SMA obstacle

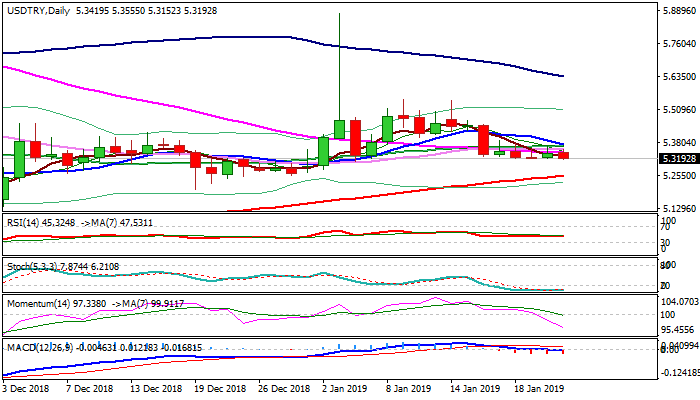

The pair trades within narrow range for the fifth straight day, with the upside being capped by a cluster of converged daily MA’s while the downside was protected by daily cloud top in past few sessions.

The action could be seen as consolidation before bears resume towards significant 200SMA support (5.2550) as daily studies are bearish.

Oversold conditions so far prevent deeper dips, however, near-term focus remains skewed lower and eventual close below daily cloud base would generate stronger signal for stretch towards 200SMA.

The latter marks breakpoint and should ideally contain the action to keep overall negative lira’s picture intact and keep alive hopes of pair’s fresh rally.

Weak economic data from Turkey weigh, along with geopolitical issues, but high CBRT’s interest rates balance the situation for now.

Conversely, sustained break below 200SMA would indicate change in overall outlook and risk test of next key support at 5.1323 (29 Nov low of pullback from new all-time USDTRY high), break of which would generate strong bearish signal.

Res: 5.3663; 5.3879; 5.4282; 5.4512

Sup: 5.2550; 5.2427; 5.2290; 5.2012