Turkish lira suffered the biggest one-day loss in five years

Turkish lira collapsed against US dollar on Wednesday, losing around 7% of its value during Asian and European trading, in the biggest daily fall since 10 Aug 2018.

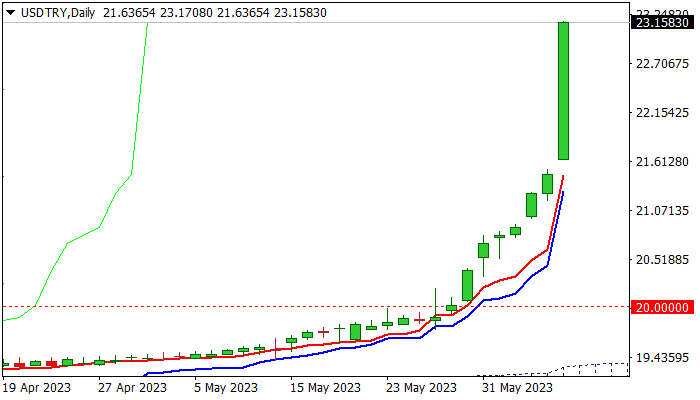

Fresh weakness signals an acceleration of lira’s larger downtrend, which gained pace after breaking psychological 20.00 barrier, with the latest strong fall being fueled by the news from new government, appointed by President Erdogan.

Although the cabinet signaled return to more orthodox economic policies after being heavily criticized recently for measures taken during the period of extremely high inflation, when the central bank strongly cut interest rates, which were described as completely unorthodox and against major rules according.

It seems that shift in Turkish government policies did not impress markets but produced a counter-effect and sparked lira’s heavy losses.

The CBRT meets on June 22, with 25 basis points hike currently on the table.

It is also very likely that current action has a pinch of political impact, as re-election of President Erdogan was not very welcomed in some countries, particularly in light of cooling relationships between Turkey and the US, after Turkey decided to keep neutral position in Ukrainian war.

The USDTRY pair continues to move deeper in uncharted territory, hitting new all-time high above 23.00 mark and eyeing initial target at 24.3803 (Fibo 161.8% projection), with growing negative signals from big banks which revised their one-year projections and expect the pair to rise to 28.0000 from initial target at 22.0000.

Lira’s strong negative sentiment so far offsets signals from USDTRY’s overbought conditions on all larger timeframes, seeing possibility for minor corrections, which would likely mark positioning for fresh lira’s weakness.

Res: 23.3803; 24.0000; 24.5713; 26.4966

Sup: 23.0000; 22.0000; 21.6365; 20.8394