Upbeat retail sales inflate pound but risk of recovery stall exists

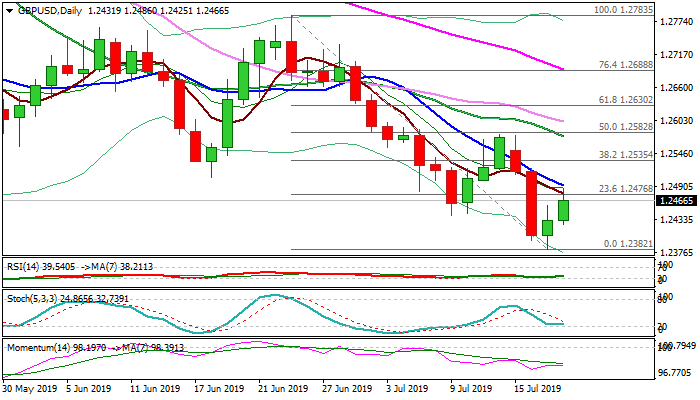

Cable accelerated higher on Thursday, extending recovery off new 27-month low at 1.2382, boosted by stronger than expected UK retail sales data.

Retail sales were up 1% in June, beating forecast of -0.3%, while annualized figure was up 3.8% from June last year vs 2.6% forecast and downward-revised May release at 2.2%.

Upbeat retail sales may boost hopes for lesser negative impact from fears of shrinking UK economy in the second quarter.

Strong data also impacted negative sentiment on no-deal Brexit, which remains pound’s key driver and maintains strong pressure.

Extended recovery faces headwinds from initial barriers at 1.25 zone (falling 10DMA / former low of 18 June), which marks pivotal barrier, along with 1.2535 (Fibo 38.2% of 1.2783/1.2382), with firm break here required to signal stronger correction.

Meanwhile, underlying bear-trend keeps in play risk of recovery stall and fresh weakness.

Res: 1.2492; 1.2505; 1.2535; 1.2576

Sup: 1.2425; 1.2396; 1.2382; 1.2354