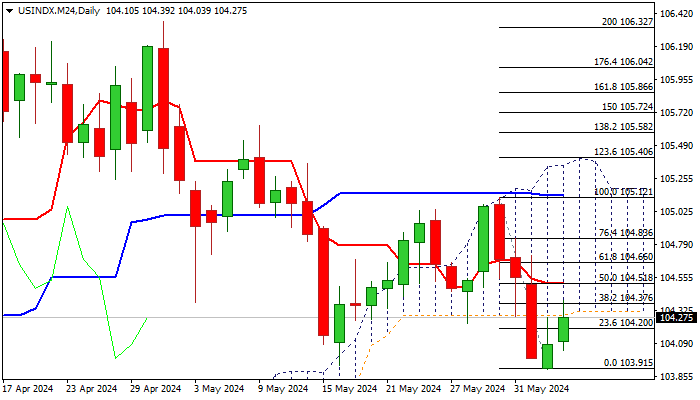

US dollar index – reversal pattern forming on daily chart as upbeat US Services PMI data provide fresh support to greenback

The dollar index accelerated higher on Wednesday, following much stronger than expected US services PMI data (May 53.8 vs 51.0 f/c and Apr 49.4) which signaled that services sector returned to growth (May figure hit the highest in nine months) and offset negative signals from downbeat labor reports (JOLTS and ADP).

Fresh advance cracked strong barriers in the 104.24/37 zone (converged 100/200DMA’s / base of thick daily cloud / Fibo 38.2% of 105.12/103.91 bear-leg) but needs close above these levels to confirm initial reversal signal, generated by Tuesday’s inverted hammer candlestick.

Sustained break higher to expose next pivot at 104.51 (50% retracement / 10DMA) and open way for further recovery on violation.

Caution on possible recovery stall, as 14-d momentum is still in the negative territory and a massive daily clouds weighs.

Res: 104.77; 104.51; 104.66; 104.83

Sup: 104.20; 103.91; 103.82; 103.65