USD INDEX – bears take a breather after Friday’s sharp fall

The dollar index edged higher on Monday morning after losing almost 1.5% on Friday (the biggest daily loss since Apr 10).

Disappointing US NFP data in July and strong downward revision of previous month’s figure, as well as higher unemployment, send warning signals to the Fed and revive the scenario about rate cut in September (and probably one more until the end of the year) which US policymakers just sidelined on Wednesday’s policy meeting.

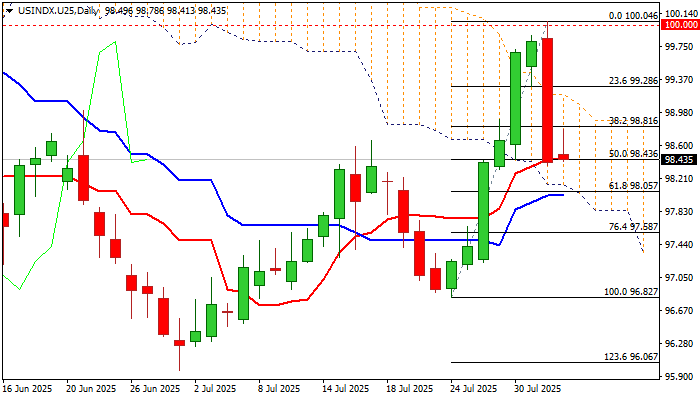

Friday’s sharp fall (emerged after failure at 100 psychological barrier) closed within falling and thickening daily Ichimoku cloud and hit 50% retracement of recent strong rally (96.82/100.04) that generated negative signal.

Fresh bears found temporary footstep at 50% retracement / daily Tenkan-sen, with today’s (so far limited) bounce, partially offsetting immediate downside risk.

Near-term action may keep in directionless mode while holding within the cloud (spanned between 98.00 and 99.00) with violation of either cloud boundary, to generate stronger direction signal.

On the longer run, dollar’s outlook is likely to remain negative, as larger downtrend is still intact after last week’s strong upside rejection (weekly candle with long upper shadow) and predominantly bearish weekly studies.

Apart from growing signals of more dovish Fed’s stance in coming months, doubts about the strength of the US economy (after strong disappointment from NFP) and rising political uncertainty would further boost demand for gold and increase pressure on dollar.

Res: 98.81; 99.08; 99.28; 99.72

Sup: 98.36; 98.03; 97.58; 97.22