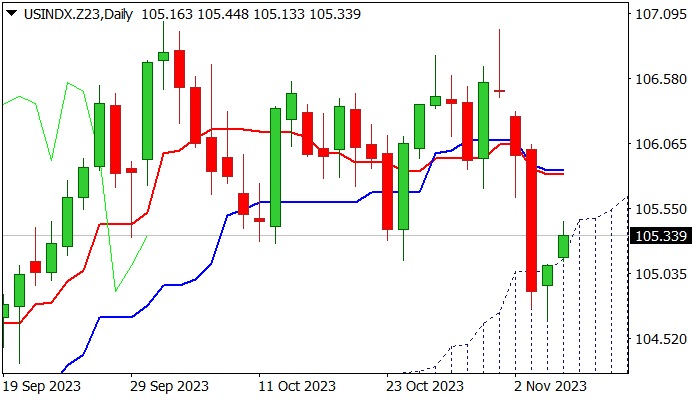

USD INDEX – bears take a breather but hold grip for now

The dollar index extends recovery from new seven-week low into second straight day, as renewed risk appetite, which pushed the dollar down 1.4% in past two days, is taking a breather.

Weaker than expected US labor data and softer tones from Fed deflated the greenback in past few sessions.

Sharp pullback, which started from Monday’s gap-lower opening and subsequent strong acceleration, lost traction on attempts to sustain penetration of rising thick daily cloud, with oversold conditions prompting traders to collect some profits and pushing the price higher.

Fresh recovery emerged above cloud top (105.15), but facing further key obstacles, which suggests that current action is just correction, before bears regain control for deep drop.

Technical structure on daily chart is bearish and favors further weakness, with corrective action to be ideally capped by Fibo resistance at 105.60 (38.2% of 106.96/104.76 bear-leg) and extended upticks not to exceed upper pivots at 105.81/85 (converged daily Tenkan-sen – Kijun-sen but still in bearish configuration) to keep fresh bears in play.

Weekly close below broken pivot at 105.14 (recent consolidation range floor) is needed to confirm bearish signal and open way for extension towards 104.04/103.78 (Fibo 38% of larger 99.20/107.03 uptrend / 100DMA) and 103.66/31 (daily cloud base / 200DMA) in extension.

Caution on sustained break above 105.81/85 barriers which would signal a false break lower and keep the price within the short-term range.

Markets await speeches from Fed Chair Powell on Wednesday and Thursday, which may give more details about the central bank’s action in the near future.

Res: 104.44; 105.60; 105.85; 106.12

Sup: 104.66; 104.04; 103.78; 103.66