USD INDEX – narrow consolidation likely to precede fresh gains

The dollar index is holding near new five-week high in early Monday and keeping firm tone, following four consecutive weeks of gains (the index was up over 3% since mid-July).

Last week’s US inflation data showed fresh increase in consumer prices (July 3.2% y/y vs June 3.0%) although core inflation ticked down (July 4.7% y/y vs June 4.8%) which keeps positive sentiment over expectations for Fed’s next steps.

Markets shift focus on the minutes of FOMC July policy meeting (due to be released on Wednesday), with prevailing expectations that the US policymakers will keep hawkish stance.

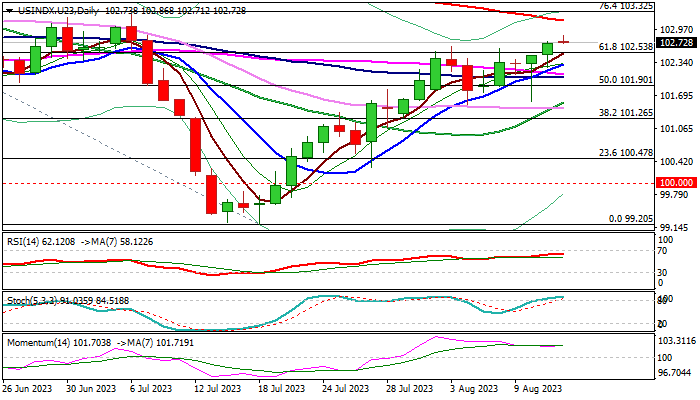

Technical picture on daily chart is bullish (strong positive sentiment / MA’s in bullish configuration), with additional positive signals from last Friday’s close above pivotal Fibo barrier at 102.53 (61.8% of 104.59/99.20) and today’s probe above thin daily Ichimoku cloud, which keeps prospects for further gains and test of next key obstacles at 103.14 (falling 200DMA) and 103.21/25 (June 30/July 7 former double top) as well as 103.32 (Fibo 76.4%).

Firm break of these barriers would add to reversal signals and open way for further retracement of larger Sep/July downtrend (114.72/99.20).

Meanwhile, overbought conditions suggest that bulls may take a breather for a shallow consolidation, which should be ideally contained by broken Fibo 61.8% resistance (102.53), with deeper dips not to exceed rising 10DMA (102.29) to keep bulls intact.

Res: 102.86; 103.14; 103.25; 103.32

Sup: 102.53; 102.29; 102.05; 101.90