USDCHF hits the lowest in 3 months as strong safe haven demand inflates Swiss franc

USDCHF remains in red at the start of the week and hit new three-month low, as safe-haves Swiss franc continues to shine on growing concerns on overheated economic and geopolitical conditions.

Anticipated impact from tariffs on imports from Canada, Mexico and China in form of destabilization of flow of goods, higher prices which would lift inflation and push America closer to recession, continues fuel worries among investors.

The pair was down 2.5% last week, in the biggest weekly drop since the last week of July last year, as the dollar was hit strongly by growing concerns about global trade war and franc benefited from migration into safety.

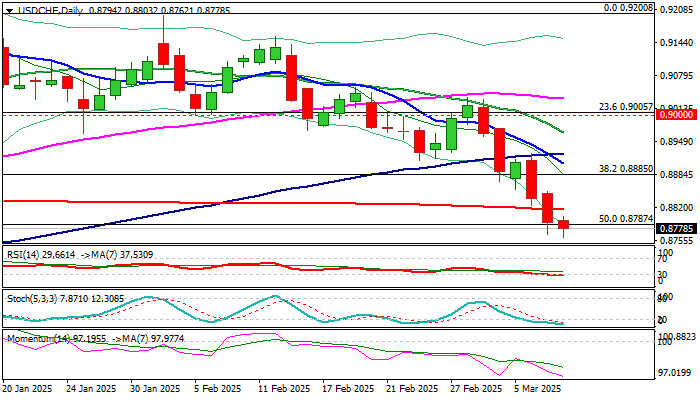

Near-term action is weighed by a massive bearish weekly candle, Friday’s close below 200DMA (0.8815) and probe through pivotal Fibo support at 0.8787 (50% retracement of 0.8374/0.9200 upleg).

Firmly bearish daily technical studies (strong negative momentum, MA’s in bearish configuration with the latest formation of 10/100 bear-cross) contribute to negative outlook.

Close below cracked 0.8787 Fibo support to add to bearish signals and open way for extension towards 0.8700 zone (psychological / Fibo 61.8%).

Meanwhile, oversold conditions warn that bears may pause for consolidation, with 200DMA to ideally cap and extended upticks not to exceed broken Fibo 38.2% (0.8885) to keep larger bears in play.

Res: 0.8815; 0.8851; 0.8885; 0.8906

Sup: 0.8762; 0.8725; 0.8690; 0.8615