USDJPY approaches 155 barrier, the zone of potential Japan’s intervention

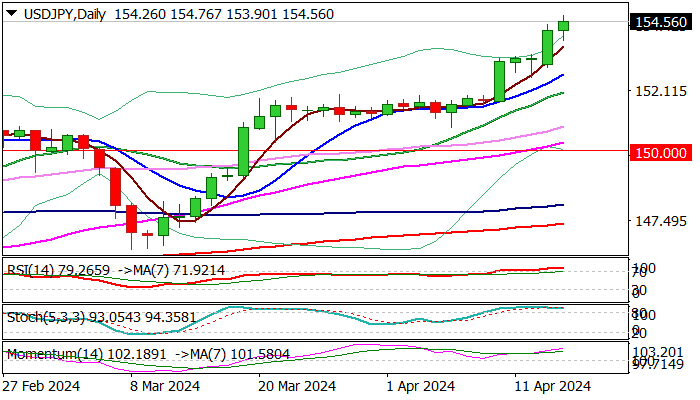

USDJPY neared 155.00 barrier on Tuesday, as the latest bullish acceleration extends into fifth straight day.

The dollar continues to benefit from growing signals about the strength of the US economy which may further delay the start of Fed rate cuts, while yen remains under increased pressure from strong dollar and a wide gap between monetary policies of two central banks (Fed and BOJ).

Technical studies remain strongly overbought on daily chart and suggest that some profit taking could be seen in coming session, while renewed talks about Japan’s intervention at 155 zone add to uncertainty.

Dips should find solid ground above former breakpoints at 152 zone to mark a healthy correction and keep larger bulls intact for fresh push higher and possible attack at 1990 peak (155.77).

Conversely, loss of 152 handle would open way for deeper correction.

Res: 155.00; 155.29; 155.77; 156.00

Sup: 154.00; 153.68; 152.66; 152.00