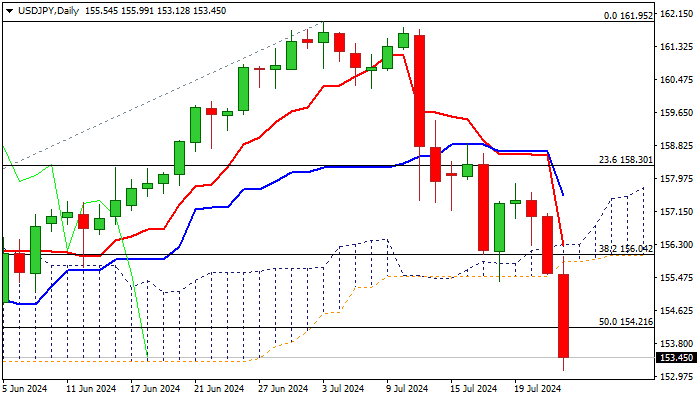

USDJPY – bears accelerate through pivotal supports

USDJPY hit 8-week low on Wednesday, as bears accelerated on Wednesday (down 1.3% for the day so far).

Bear-leg from 157.86 (July 19 lower top) broke through rising and thickening daily cloud (156.30/155.87), 100DMA (155.34) and 50% retracement of 146.48/161.95 (154.21), in extension of the pullback from new multi-decade high (161.95).

This signals that yen bulls regained strength, following interventions by Japanese authorities and growing expectations that the Fed would start easing monetary policy in coming months.

Reversal signals have been formed on daily and weekly chart, adding to prospects for further downside.

Bears eye targets at 152.39 and 151.59 (Fibo 61.8% / 200DMA), though oversold daily studies may spark a partial profit-taking and push the price higher.

Broken Fibo 50% reverted to initial resistance (154.21) with 100DMA (155.34) to cap upticks and guard upper pivots, marked by daily cloud (Tenkan-sen reinforces cloud top) violation of which to sideline bears.

Res: 154.21; 155.34; 155.87; 156.30

Sup: 153.12; 152.76; 152.39; 151.59