USDJPY – bears remain firmly in play but stronger action could be on hold until FOMC

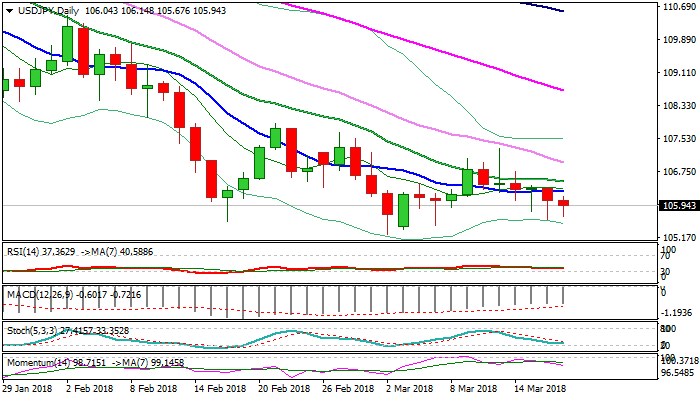

The pair holds in red on Monday and probes again through 106 support (Fibo 61.8% of 105.24/107.29 upleg), following last Friday’s short-lived dip to 105.60, two-week low).

Negative daily techs maintain pressure as last week’s strong upside rejection under falling 30SMA weighs.

Bears eye lower 20-d Bollinger band (105.50) as the last obstacle en-route to 105.24 (02 Mar low) and psychological 105 support, break of which would spark fresh bearish acceleration, on triggering a number of stops below.

The notion is supported by strong risk aversion which keeps yen supported, however, the pair may stay on hold until FOMC decision on Wednesday which could generate stronger direction signal.

Broken 10SMA marks initial resistance at 106.26, followed by 20SMA at 106.51, firm break of which would sideline immediate downside threats, while lift above falling 30SMA (106.97) is needed to neutralize and shift focus higher.

Res: 106.15; 106.26; 106.51; 106.97

Sup: 105.60; 105.50; 105.24; 105.00