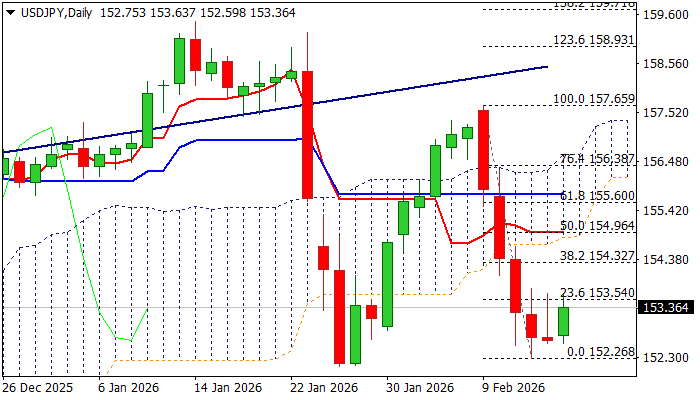

USDJPY – bears take a breather after almost 3% weekly drop

USDJPY bounced on Monday on partial profit taking after last week’s almost 3% drop (the biggest weekly loss since Nov 2024).

Weaker dollar and growing optimism after PM Takaichi’s election victory, contributed to fresh strength of Japanese currency last week.

Recovery attempts were so far repeatedly capped by initial Fibo barrier at 153.54 (23.6% of 157.69/152.26 bear-leg), suggesting that correction is likely to be limited and provide better selling levels.

Technical signals are still mixed as 14-d momentum emerged from negative zone and heads north and stochastic is reversing in oversold territory, conflicting MAs in bearish configuration.

Next good barrier above 153.54 lays at 154.32 (Fibo 38.2%), with 153.90 zone (daily cloud base / 50% retracement) expected to cap extended upticks and mark a healthy correction before bears regain control.

Massive weekly bearish candle (which also completed bearish engulfing pattern) weighs on near-term action and contributes to negative scenario.

Res: 153.75; 154.32; 154.90; 155.68

Sup: 152.60; 152.26; 152.00; 151.05