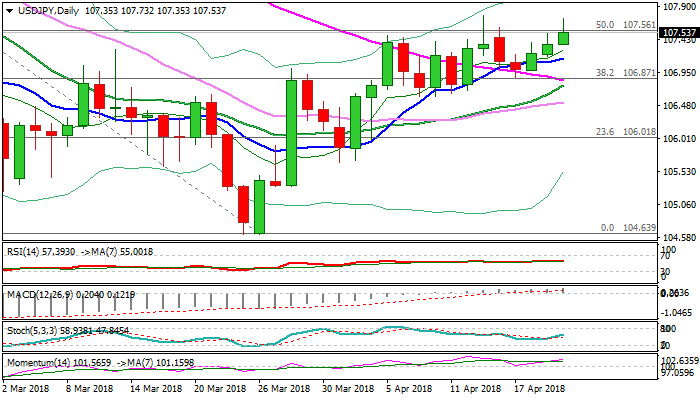

USDJPY – bulls extend into third straight day and look for eventual break above 107.50 Fibo barrier

The pair advances for the third straight day and probes again through Fibo barrier at 107.55 (50% retracement of 110.48/104.63), which capped upside attempts since late Feb.

Today’s extension of bull-leg from 106.86 trough approached key near-term barrier at 107.77 (13 Apr high), looking for break higher to signal extension of recovery from 104.63 (26 Mar low) towards next targets at 107.90 (21 Feb high) and 108.25 (Fibo 61.8% of 110.48/104.63).

The dollar was up across the board on Friday, while yen came under renewed pressure on weaker than expected Japan’s CPI data.

Weekly close above 107.55 is needed for bullish signal of extension of recovery leg from 104.63.

Daily MA’s in bullish setup and strengthening momentum studies support positive scenario.

Rising 10SMA marks solid support at 107.16 which should ideally hold downticks and guard key support at 106.84 (daily cloud base / 55SMA).

Res: 107.77; 107.90; 108.25; 108.77

Sup: 107.35; 107.16; 106.84; 106.52