USDJPY – bulls may pause for consolidation

The dollar keeps strong bullish stance against yen and extends the latest strong rally into third straight day, advancing more than 2% since Monday.

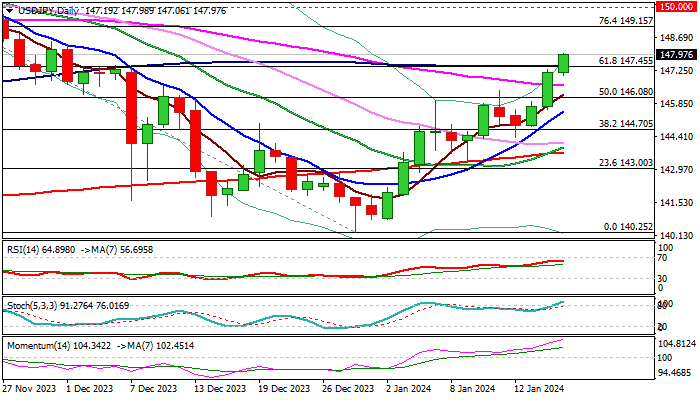

Cooling expectations Fed’s early rate cut provided fresh tailwind to the greenback, as bulls broke through pivotal barrier at 147.45 (Fibo 61.8% of 151.90/140.25 / 100DMA) and pressure round-figure resistance at 148.00.

Close above 147.45 to further strengthen bullish structure and open way for further gains, with sustained break through 148.00 to expose target at 149.15 (Fibo 76.4%).

Meanwhile, bulls may take a breather as daily indicators are stretched and hourly RSI is diverging from rising price, adding to signals that bulls might be running out of steam.

Shallow dips should be ideally contained by broken 147.45 barrier, reverted to solid support and precede fresh push higher.

Caution on dip below 55DMA (146.62) which would weaken near-term structure and risk deeper pullback.

Res: 148.51; 148.83; 149.15; 149.70

Sup: 147.45; 147.00; 146.62; 146.08