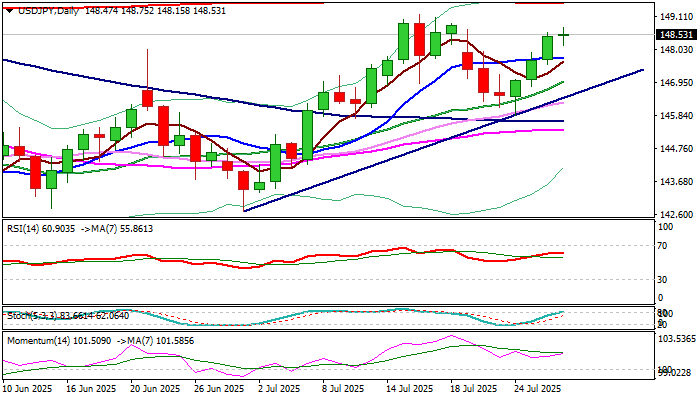

USDJPY – bulls start to lose traction ahead of key barriers but still hold grip

Strong rally in past three days started to run out of steam on Tuesday, as daily action was so far shaped in long-legged Doji candle that signals indecision.

Bulls show signs of fatigue after retracing over 76.4% of 149.18/145.85 bear-leg and hitting recovery high just under key near-term support at 149.18 (July 16 peak), where the rally faced headwinds.

Overbought daily Stochastic contributes to developing negative signals, but overall picture on daily chart remains firmly bullish, suggesting that consolidation or shallow correction may precede fresh push higher, with probe through 149.18 and 149.53 (200DMA) to expose psychological 150 barrier.

Dips should ideally find support at 147.70/50 zone (10DMA / Fibo 38.2% of 145.85/148.75 upleg) to mark a healthy correction and keep bulls intact.

Res: 148.75; 149.18; 149.53; 150.00

Sup: 148.06; 147.65; 147.50; 147.30