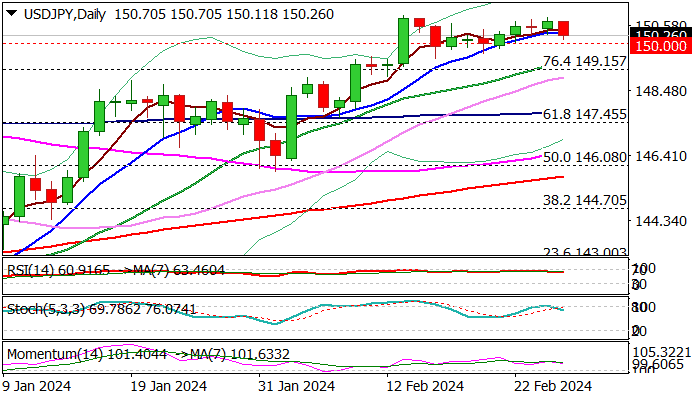

USDJPY – bulls to remain in play while holding above broken Fibo barrier

USDJPY eases on Tuesday as traders reacted on overbought daily studies, but dips are likely to be limited and mark a healthy correction of larger uptrend.

Technical picture on daily chart remains bullish (strong positive momentum / moving averages in bullish configuration) keeping in play expectations for final push towards key barriers at 150.90/94 (peaks of 2023 and 2022 respectively).

Bullish outlook is supported by the fact that the pair holds above broken pivotal barriers at 150.00/149.15 (psychological / Fibo 76.4% of 151.90/140.25) for the third week and near-term action is expected to remain biased higher while these supports contain dips.

Initial support at 150.18 (daily Tenkan-sen) has been cracked but so far without clear break, guarding 150.00 level and 149.41/15 (20DMA / Fibo 76.4%).

Only sustained break of 149.15 would neutralize bulls and open way for deeper correction of 140.25/150.88 rally.

A number of economic releases from the US these days (focus is on Q4 GDP and PCE index) are expected to provide fresh signals.

Res: 150.29; 150.64; 150.88; 151.43

Sup: 150.00; 149.41; 149.15; 148.39