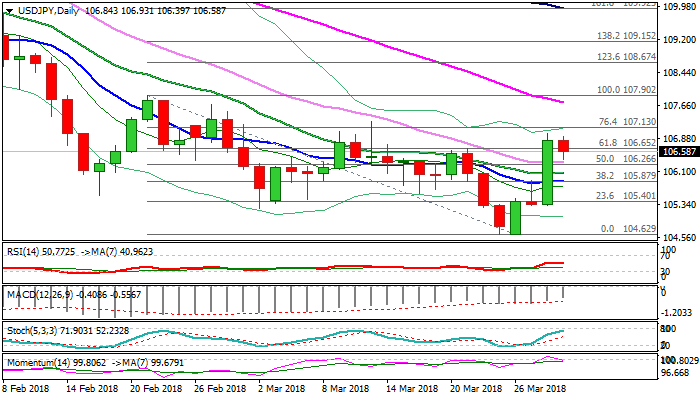

USDJPY consolidates under fresh recovery high; bullish n/t structure to remain intact while above broken 30SMA

The pair is consolidating under fresh recovery high at 107.01 on Thursday, after previous day’s strong rally when dollar was up 1.5% against yen, on the biggest one-day rally s since 15 June 2017.

The structure on daily chart improved after Wednesday’s rally as the price broke above a cluster of MA’s and another bullish signal was generated on close above 106.65 (Fibo 61.8% of 107.90/104.63 descend, which keeps near-term focus at the upside, but the sentiment could be soured by weakening momentum studies.

Corrective easing is expected to hold above broken 30SMA (106.34), former pivotal barrier, now strong support, to keep fresh bulls intact.

Sustained break above psychological 107 barrier would open way for test of 107.29 (13 Mar high) and would expose key barrier at 107.90 (21 Feb high / base of falling daily cloud).

Conversely, xtension below 30SMA would sideline immediate bears, while return below broken 10SMA (105.89) is needed to neutralize and signal lower top at 107.01.

Res: 107.01; 107.13; 107.29; 107.90

Sup: 106.34; 106.07; 105.89; 105.32