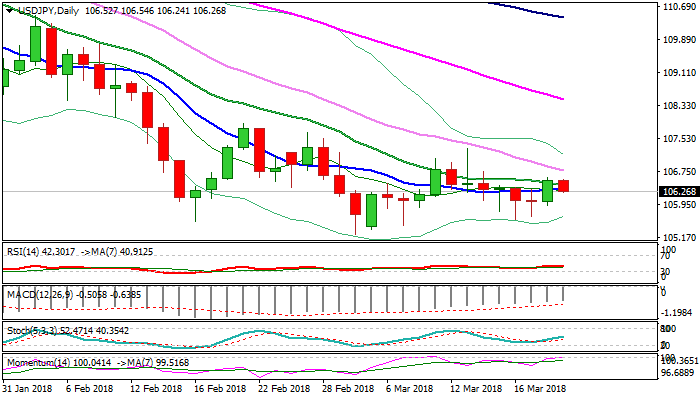

USDJPY – daily Kijun-sen weighs and caps recovery; Fed’s decision expected to give stronger direction signal

The pair holds in red on Wednesday, keeping overall bearish bias intact after strong rally on Tuesday which peaked at 106.60.

Recovery stalled as daily Kijun-sen in steep fall (currently at 106.57) weighs heavily and capped today’s action.

Fresh easing returned below converged 10/20SMA’s, bringing daily techs back to full bearish setup, as 14-d momentum turned sideways, unable to break positive zone border line.

Larger picture shows the action in past three weeks, above fresh low at 105.24 as consolidation before broader bears continue.

The pair looks for a catalyst for fresh action and the outcome of Fed’s policy meeting could provide stronger direction signal.

Hawkish Fed would generate bullish signal for eventual break above daily Kijun-sen and 55SMA barriers (106.57 and 106.77 respectively) and would open way towards upper pivots at 107.00 (psychological) and 107.29 (13 Mar spike-high) pivots, break of which will be bullish.

Conversely, close below Friday’s low at 105.60 would risk retest of 105.24 and attack at psychological 105.00 support, loss of which would be bearish.

Res: 106.57; 106.77; 107.00; 107.29

Sup: 106.24; 105.92; 105.60; 105.24