USDJPY eases after hawkish comments on BOJ interest rates

USDJPY dips below 150 mark in early Thursday’s trading, as yen received fresh boost from BOJ policymaker’s hawkish comments regarding interest rates and month-end position adjustments.

Economic data from Japan, released overnight were mixed, as retail sales remained solid in January, but industrial production fell below expectations, causing limited impact.

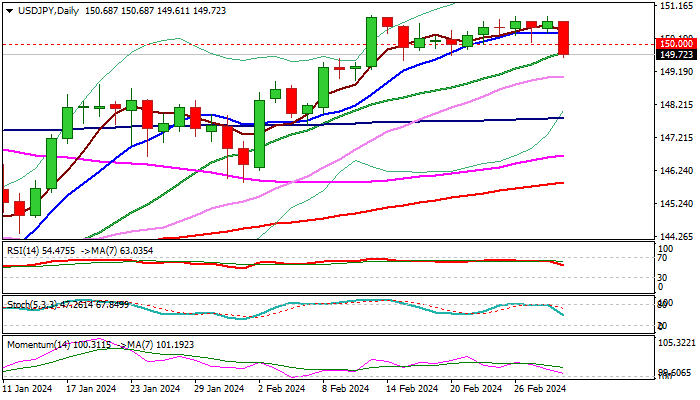

Fresh bears cracked the floor of near-term consolidation range at 149.60 zone (reinforced by rising 20DMA and Fibo 23.6% of 145.89/150.88 upleg), with sustained break lower needed to generate bearish signal for deeper correction.

Fading bullish momentum on daily chart and south-heading RSI support the action, though traders await release of US inflation report (PCE, due later today) which is expected to provide more details about inflation trajectory and contribute to Fed’s interest rate outlook.

Extended pullback to target supports at 147.97 (Fibo 38.2% of 145.89/150.88) and 148.38 pivot (50% retracement / daily Kijun-sen).

Conversely, failure to clear 150.00 and 149.60 supports would signal that fresh bears lack strength and keep the price within extended range, but biased higher, as the pair is on track for the second consecutive monthly gain and eyeing key barriers at 151.90/94 (2022/2023 peaks).

Res: 150.00; 150.32; 150.88; 151.43

Sup: 148.97; 148.38; 147.80; 147.07