USDJPY eases further on Fed rate cut speculations and Japan’s readiness to intervene again if necessary

USDJPY fell to the lowest in nearly three weeks on Tuesday, in extension of the bear-leg from 157.70 (May 29 lower top) driven by weaker dollar on signals of potential earlier Fed rate cut and comments from Japan’s officials about results of the recent intervention (worth $62 billion) in attempts to stabilize yen and signals that the authorities will continue to monitor the situation and remain ready to act again.

Weaker than expected US JOLTS job openings (April figure hit the lowest since Feb 2021) signal that US labor market is softening which contributes to expectations for earlier than expected Fed’s action on interest rates.

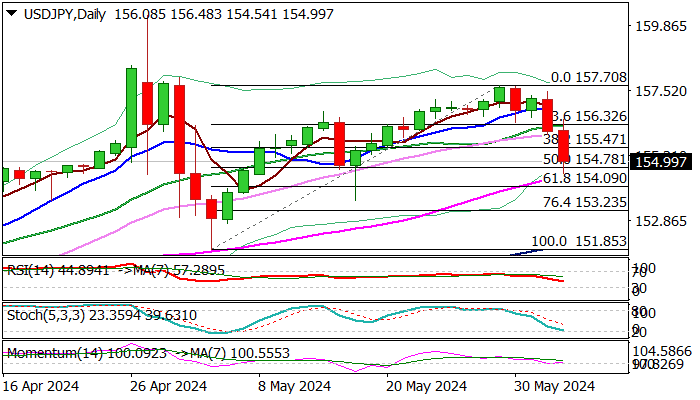

Technical picture on daily chart is weakening ais 14-momentum moved into negative territory and 10/20DMA’s turned to bearish configuration.

Fresh bears cracked Fibo support at 154.78 (50% retracement of 151.85/157.70 upleg) and pressure next pivot at 154.40 (55DMA), with clear break of these levels to add to bearish near term outlook.

Near-term bias to stay with bears while the upside is capped by daily cloud top (156.12).

Markets shift focus towards next key economic events this week (US non-manufacturing PMI, ADP private sector payrolls and key NFP report) which are expected to generate stronger signals.

Res: 155.47; 156.12; 156.82; 157.01

Sup: 154.40; 154.09; 153.23; 152.76