USDJPY eases further on rate cut expectations but key supports still hold

USDJPY fell further on Wednesday as dovish remarks from Fed Powell added to expectations for Fed rate cuts in October and December and kept the dollar at the back foot.

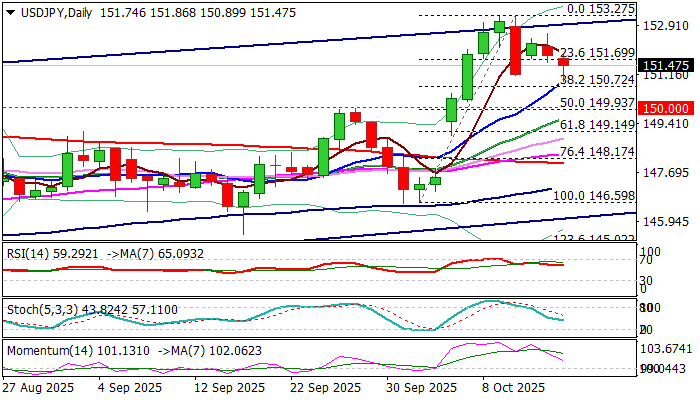

Fresh bears hit one week low but faced strong headwinds at initial support at 150.90 (rising 10DMA / former top of Aug 1), guarding more significant supports at 150.76/72 (weekly cloud top / Fibo 38.2% of 146.59/153.27) and 150 zone (psychological / nearby daily Tenkan-sen / Fibo 50% retracement.

Wednesday’s action was so far shaped in a Hammer candle which may signal that corrective leg from 153.27 (Oct 10 peak) might be running out of steam.

Overall bullish daily studies (multiple golden crosses / 14-d momentum still holding well above the centreline / RSI at 60) may contribute to such scenario and signal that larger bulls might be returning to play after a rather shallow correction.

Daily close above 150.90/72 would boost the signal, however, more action to the upside will be still required to confirm (lift above Tuesday’s high at 152.61 and broken upper bull-channel boundary at 152.88).

Conversely, sustained break of 150.72 to generate bearish signal, with extension below 150 pivot to open way for deeper correction.

Res: 150.90; 151.86; 152.61; 152.88

Sup: 150.72; 150.00; 149.61; 149.14