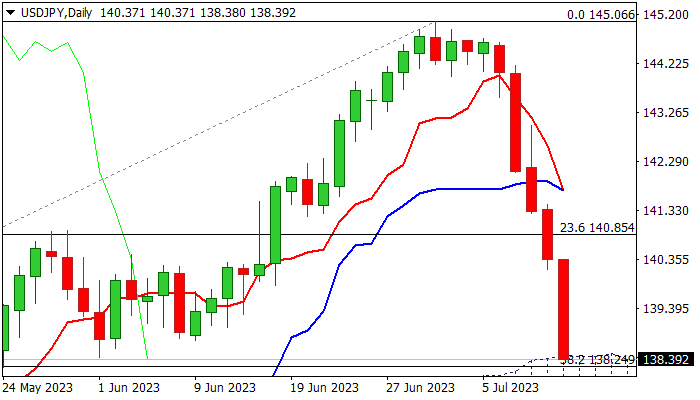

USDJPY falls to new multi-week low after US CPI data and cracks key support zone

USDJPY fell to six-week low on Wednesday, extending steep downtrend into fifth straight day, in fresh acceleration after softer than expected US CPI data.

The dollar lost ground on initial signals that Fed’s tightening cycle is nearing its end, with stronger than expected inflation easing in June, contributing to scenario.

Although the US central bank is on track to raise interest rates this month, after pausing in June, the latest data add to signals that sharp increase in interest rates during the past over one year, started to give more significant results, keeping inflation in a downtrend, which contributes to idea that inflation has peaked.

Fresh bearish acceleration on Wednesday (the pair was down 1.3% until early hours of the US session) is pressuring key supports at 138.44/24 (daily cloud top / Fibo 38.2% of 127.22/145.06), with firm break here to confirm reversal and open way for deeper correction of 127.22/145.06 rally.

Technical picture has weakened significantly, as 14-d momentum remains in steep decline and deeply in negative territory and moving averages (10/20/30-d) turned to bearish configuration, although oversold conditions may slow bears for a partial profit-taking ahead of key supports.

Upticks should stay capped under broken psychological 140 support, now reverted to resistance, to keep bears in play for fresh extension lower.

Res: 139.00; 139.60; 140.00; 140.85

Sup: 138.24; 137.42; 137.14; 136.94