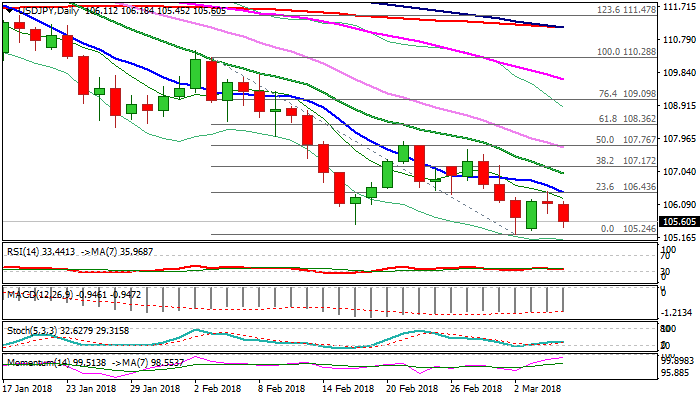

USDJPY – fresh bearish acceleration after recovery stall revives bearish bias

The pair accelerated lower on Wednesday after resignation of Trump’s advisor Cohn, pressured dollar and sparked fresh risk aversion, increasing demand for safe-haven yen.

Fresh weakness was signaled by recovery stall at 106.44 Fibo 23.6% barrier on Tuesday and daily trading shaped in long-legged Doji, with subsequent fall, completing reversal.

Near-term focus turns lower after limited correction, eyeing low at 105.24 (02 Mar) and psychological 105 support, with break lower to spark stronger bearish acceleration.

Negative stance is reinforced by firm bearish setup of daily studies, favoring continuation of larger downtrend on break below 105.24 / 00 pivots.

Near-term action is pressured by thick hourly cloud (105.85/106.08) which guards strong barrier and upper pivot at 106.44 (Fibo 23.6% of 110.28/105.24 fall, reinforced by descending 10SMA).

Only firm break above 106.44 would sideline downside risk and signal further recovery.

Res: 105.85; 106.18; 106.44; 106.96

Sup: 105.45; 105.24; 105.00; 104.64