USDJPY hits new 24-year high on solid NFP and dovish BoJ

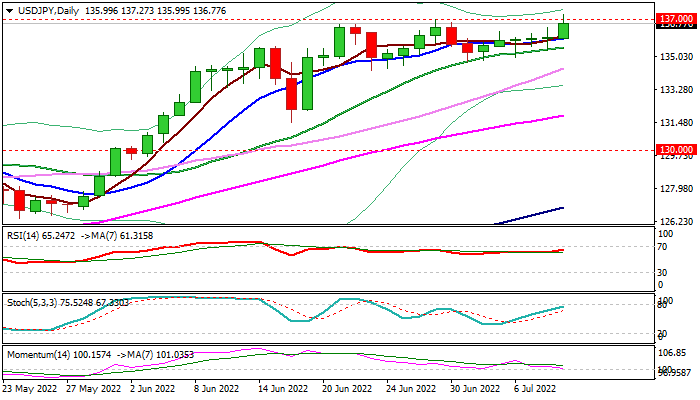

The USDJPY regained traction on Monday and rose to new 24-year high on probe through recent range top at 137.00.

The dollar gained support from Friday’s better than expected US jobs data, while pressure on yen increased after BoJ reaffirmed its ultra-easy monetary policy.

Sustained break of 137.00 pivot is needed to trigger stops parked above and signal continuation of larger uptrend towards 140 zone (Sep 1998 high / psychological).

Although fundamentals are supportive, technical studies on daily chart are losing bullish momentum and weeklies are overbought that warns of difficulties bulls may face at 137 resistance zone.

Prolonged range trading should hold above daily Tenkan-sen (136.01) to keep immediate bias with bulls and keep intact next pivotal supports at 135.49 (20DMA) and 134.30 (recent range floor).

Res: 137.00; 137.27; 137.63; 138.21

Sup: 136.01; 135.49; 134.74; 134.49