USDJPY hits new multi-month high, but possible FX intervention urges caution

USDJPY accelerated higher on Wednesday, as breach of recent multi-tops (148.50) triggered stops and pushed the price to the highest since early February.

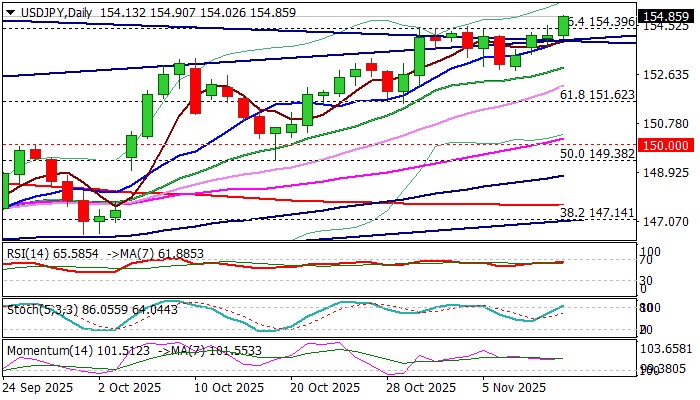

The pair was up 0.45% on Wednesday morning, with recent break above bull-channel upper boundary and bear-trendline off 161.95 (153.92/95) / Fibo 76.4% of 158.87/139.88 (154.39 respectively) generating fresh bullish signal.

Daily close above the latter to verify the signal.

Bulls neared 155.00 (round-figure barrier), violation of which would provide fresh boost on triggering stops, parked just above and expose next targets at 155.88 and 156.24.

Technical studies remain firmly bullish on daily chart and supports the action, with currently preferred scenario of limited profit taking to mark positioning for further advance.

Dips should stay above 154.00 (converged and crossing trendlines) to keep bias firmly with bulls.

However, market participants remain very cautious of potential intervention of the Japanese central bank, which is not very happy with sharp weakening of the national currency.

Although the intervention signals were so far only verbal, without more significant signals, it remains as one of very likely scenarios in the near-term.

Res: 155.00; 155.88; 156.24; 156.50

Sup: 154.39; 154.00; 153.40; 152.90