USDJPY keeps bullish bias but looks for direction signal

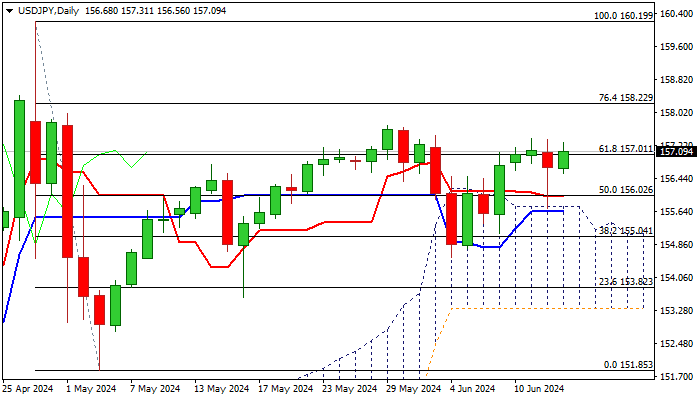

USDJPY remains resilient following limited negative impact from CPI/Fed on Wednesday and today’s jobless claims and PPI data but continues to struggle to clear June’s peak at 157.47.

Near-term action is holding within a range which extends into fourth straight day, ahead of Friday’s BoJ policy meeting, which may have stronger impact only if cb’s decision significantly diverges from expectations.

Daily studies are bullishly aligned but overbought conditions may cause headwinds, which may shape weekly action in the third consecutive Doji candle.

We look for initial positive signal on break of 157.47 and verification on list above May’s peak at 157.98, to open way towards targets at 160.00/19 (psychological / Apr 29 peak), though increased risk of intervention could be expected in such case.

Bullish near-term bias expected above 10DMA (156.45) while violation of daily Tenkan-sen (156.00) would risk test of lower pivot at 155.76 (daily cloud top).

Res: 157.31; 157.47; 157.70; 158.00

Sup: 156.56; 156.00; 155.76; 155.04