USDJPY keeps firm bearish stance, eyes BoJ rate decision for fresh signals

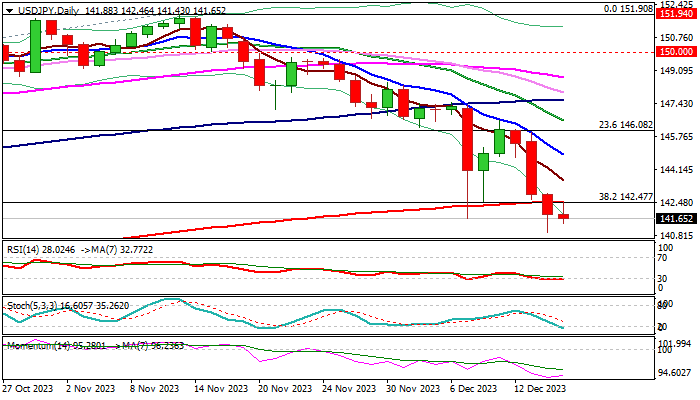

Bears slowed on Friday and the price action is consolidating above new multi-month low (140.95) but keeping firm bearish stance, as the pair is on track for the fifth consecutive weekly loss.

Thursday’s close below pivotal support at 142.48 (Fibo 38.2% of 127.22/151.90 / 200DMA) generated fresh negative signal and firmed bearish structure, with weekly close below this level, to confirm signal.

However, bears may face stronger headwinds as daily studies are oversold, though pair’s direction in the near term will be mostly defined by fundamentals.

The Federal Reserve reinforced its dovish stance in the policy meeting earlier this week, by keeping interest rates on hold again and signaling that tightening cycle is likely over, which raised bets about rate cuts in 2024.

On the other hand, the Bank of Japan will hold policy meeting next Tuesday, with growing speculations that policymakers will start hiking interest rate and signal an end of long-lasting ultra-loose monetary policy.

Japanese yen would benefit more from such decision, particularly from the fact that BoJ is about to start raising interest rates while other major central banks talk about rate cuts.

Bears eye targets at 140.00 and 139.56 (psychological / 50% retracement of 127.22/151.90), with 200DMA to ideally cap and keep larger bears intact.

Res: 142.48; 142.90; 143.58; 144.85

Sup: 141.43; 140.95; 140.00; 139.56