USDJPY maintains bullish tone but caution on fresh risk aversion

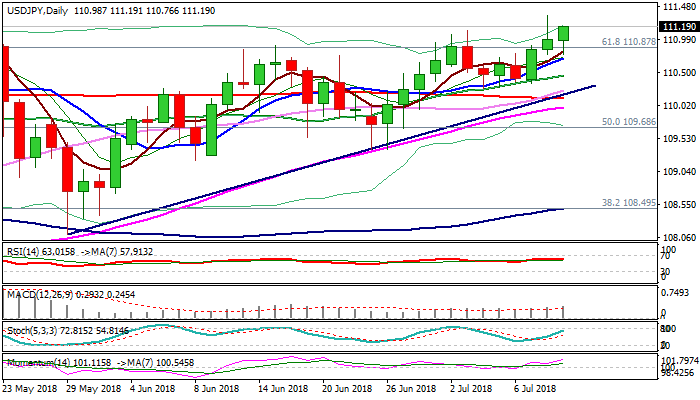

The pair holds positive tone on Wednesday but holding below previous day’s spike high at 111.35 for now.

Strong rejection on initial attempt at key barrier at 111.39 (21 May high) could be seen as hesitation which requires extended consolidation before final break higher.

Such scenario is supported by strong bullish setup of daily techs and double twist of weekly cloud, which usually attracts.

Also, Tuesday’s eventual close above important Fibo barrier at 110.87 (Fibo 61.8% of 114.73/104.63) following multiple failures in past three weeks, would add to positive signals for bullish continuation.

Firm break above 111.39 pivot would then open way towards 112.35 target (Fibo 76.4% of 114.73/104.63).

On the other side, fundamentals seem to be working against the dollar as renewed talks about further US tariffs on goods from China would spark fresh risk aversion and prompt traders into safe-haven yen.

Negative scenario needs initial signal on fall below higher base at 110.30 zone to spark further bearish acceleration and turn bias into negative mode.

Sustained break below 110.30 would risk extension towards 109.36 (25/26 June trough).

Res: 111.39; 112.00; 112.35; 112.78

Sup: 110.77; 110.46; 110.30; 110.00