USDJPY – more work at the upside needed to strengthen bullish structure

The USDJPY keeps positive tone for the third consecutive day, as improved sentiment and solid US jobs data underpin dollar.

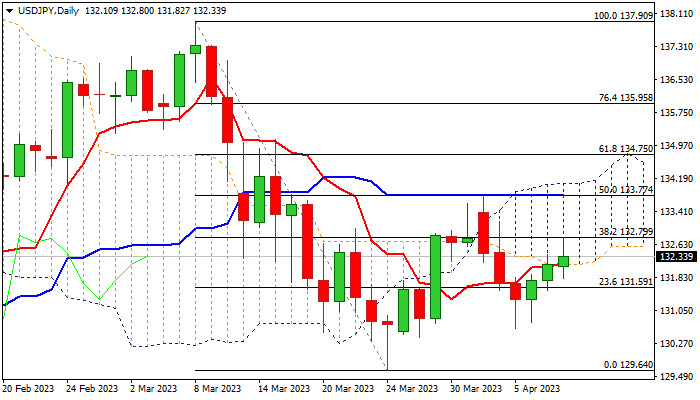

Fresh extension in early Monday penetrated thick daily Ichimoku cloud (cloud base lays at 132.15) and cracked pivotal Fibo resistance at 132.79 (38.2% of 137.90/129.64).

Holding above cloud base (reinforced by daily Tenkan-sen) is seen as minimum requirement to keep bulls in play, with extension and close above 132.79 barrier, to open way for further recovery.

Key barriers lay at 133.75/77 (Apr 3 high / 50% retracement of 137.90/129.64 / daily Kijun-sen) and 134.08 (daily cloud top), with sustained break here to generate strong bullish signal (also on completion of bullish failure swing) and expose targets at 134.75/135.11 (Fibo 61.8% / mid-Mar lower platform).

Caution on dip and close below daily cloud base (as bullish momentum is fading on daily chart and sends warning signals) which would signal recovery stall and possible end of three-day recovery.

Res: 132.80; 133.16; 133.77; 134.08

Sup: 132.15; 131.59; 131.00; 130.62