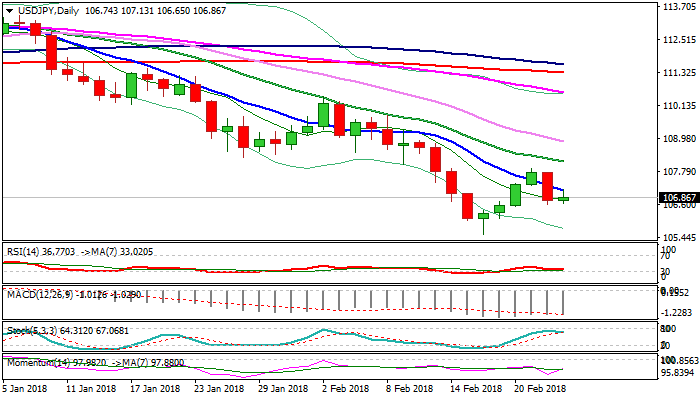

USDJPY – near-term bias turns negative after Thursday’s fall

The pair is consolidating on Friday after suffering heavy losses previous day. Near-term action is holding below 107 handle (broken Fibo 38.2% of 105.54/107.90 upleg, reinforced by falling 10SMA) for now and maintains downside pressure, following repeated failure under technical / psychological barrier at 108.00 (50% of 110.48/105.54 bear-leg) and subsequent strong bearish acceleration.

Underlying bear-trend received fresh negative signal on Thursday’s fall which turned near-term bias to bearish mode.

Near-term action is weighed by Thursday’s long red candle, keeping focus at next pivotal support at 106.44 (Fibo 61.8%) break of which would confirm lower top and open way towards key near-term support at 105.54 (2018 low, posted on 16 Feb).

Alternative scenario requires close above 108 barrier to sideline near-term bears.

Res: 107.00; 107.34; 107.66; 107.90

Sup: 106.59; 106.44; 106.10; 105.54