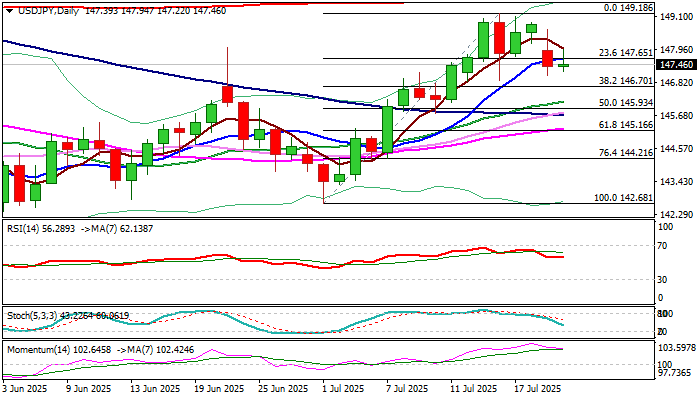

USDJPY – pullback to find firm ground above 146.70 to keep larger bulls intact

Narrow consolidation follows Monday’s drop which found temporary footstep at 147 zone.

Pullback from last week’s three-month high (149.18) pauses but still has more space to extend lower.

Fibo 38.2% retracement of 142.68/149.18 (146.70) marks solid support which should contain dips and mark healthy correction of the bull-leg from 142.68, before larger bulls regain traction.

Repeated daily close below 147.65 (broken 10DMA / Fibo 23.6%) to keep the downside vulnerable, though overall bullish structure on daily chart, works in favor of scenario of limited correction before fresh push higher.

However, fundamentals are likely to be a key driver again, with markets focusing on Aug 1 tariff deadline.

Situation may deteriorate if no deal is found until then and prompt fresh rally into safety that would support yen.

In such scenario, the pair may accelerate through 146.70 and violate other pivots at 146 zone (20DMA / 50% retracement / 100DMA) that would weaken near-term structure and risk deeper drop.

Res: 147.65; 148.00; 148.66; 149.00

Sup: 147.00; 146.70; 146.19; 145.93