USDJPY rallies on diverging BoJ/Fed rate outlook

USDJPY rallied on Thursday (up 0.80% until early hours of the US session) as BoJ kept dovish stance in rate talks which deflated yen, while dollar appreciated from growing signs that the Fed would slow the action towards rate cuts in 2024.

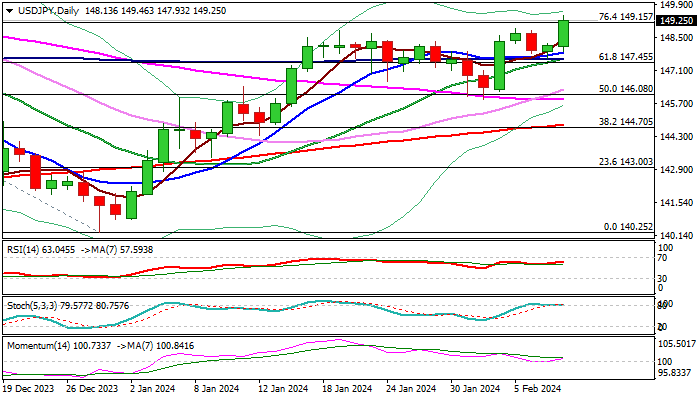

The pair rose to the highest in more than two months, as fresh strength broke above former top at 148.80 (Jan 19), signaling an end of 148.80/145.89 corrective phase and bullish continuation.

Break of Fibo barrier at 149.15 (76.4% of 151.90/140.25) generated fresh bullish signal (which will require verification on close above this level) for attack at psychological 150 resistance.

Rising positive momentum and moving averages in full bullish configuration on daily chart, underpin the action, though overbought stochastic warns that bulls may face headwinds on approach to 150 barrier.

Rising 10DMA (147.90) should contain dips to keep bulls intact for 150+ acceleration.

Res: 149.70; 150.00; 150.77; 151.43

Sup: 149.15; 148.80; 147.90; 147.45