USDJPY recovers part of recent losses ahead of Fed

USDJPY edged higher on Tuesday on partial profit-taking from strong drop in past three days (the pair was down 2%).

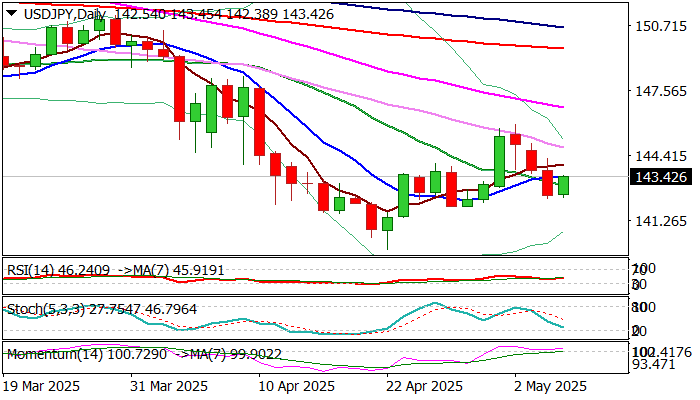

Bounce was so far limited (retraced slightly above 23.6% of 145.92/42.35 bear-leg), with mixed technical studies (daily Tenkan/Kijun-sen in bearish setup 14 -d momentum still in positive territory), but near-term action remains weighed by recent formation of bull-trap on daily chart (above 50% of 151.20/139.88 downtrend / daily Kijun-sen).

Latest signals of potential US-China trade deal, partially offset signals for increased safe-haven demand on fresh escalation of India / Pakistan conflict.

Markets focus on tonight’s Fed announcement, looking for more clues about the US central bank’s rate trajectory in coming months.

Daily close above 10DMA (143.32) is seen as minimum requirement to keep in play hopes for stronger recovery and challenge of next pivotal barriers at 143.71/93 (Fibo 38.2% / daily Tenkan-sen).

Conversely, early recovery rejection would signal that larger bears hold grip and keep in play risk of retesting key 140 support zone.

Res: 143.71; 143.93; 144.13; 144.55

Sup: 143.19; 142.90; 142.35; 141.94