USDJPY – recovery acceleration signals that corrective phase might be over

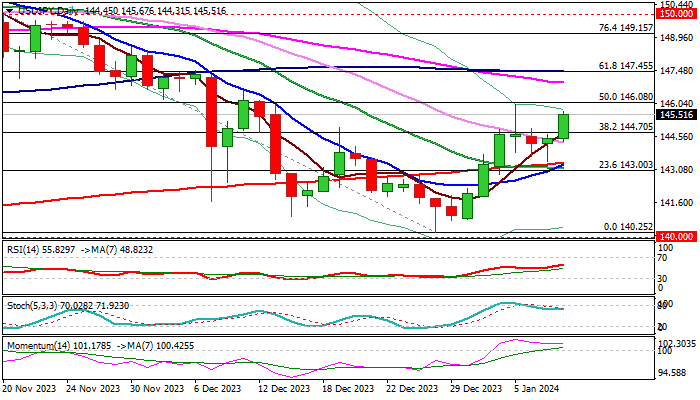

Bulls regained traction and pushed the price up 0.75% on Wednesday, retracing the largest part of pullback from 2024 high (145.97, Jan 5) to 143.41 (Jan 9).

Fresh strength emerged after corrective dip was strongly rejected just above 200DMA (143.37), marking a healthy correction and keeping in play near-term bulls off 140.25 (Dec 28 low).

Converging 10/200DMA’s are on track to form golden-cross and further support the action, underpinned by predominantly bullish daily technical studies.

Bulls eye pivotal 146.00 resistance zone (recent peak / 50% retracement of 151.90/140.25), break of which to signal bullish continuation and expose targets at 146.95/147.45 (55DMA / Fibo 61.8%, reinforced by 100DMA).

Daily close above 145.00 handle to confirm bullish stance.

Yen lost ground on fading BoJ rate hike hopes, while traders await release of US December inflation report to get more clues about Fed next steps, amid growing talks that the central bank may start cutting interest rates as early as March, though Fed remains cautious and looks for more evidence before taking an action.

Res: 145.75; 145.97; 146.08; 146.58

Sup: 145.00; 144.70; 144.29; 143.66