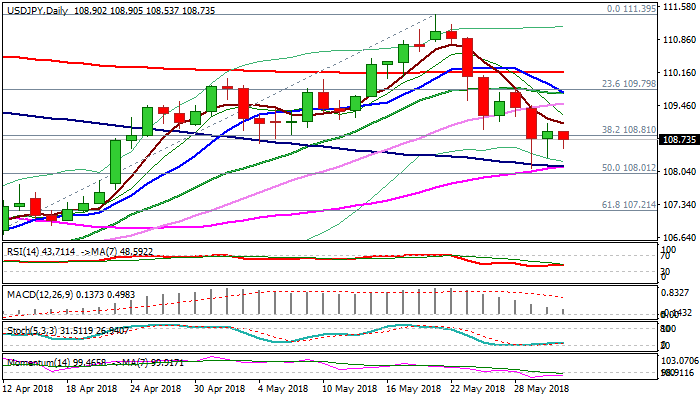

USDJPY – recovery shows signs of stall; 30SMA remains key barrier

Recovery action from 108.11 (29 May low) shows initial signs of stall, as upside attempts were rejected at 109.07 on Wednesday, failing to break above the top of falling hourly cloud and capped by falling 5SMA, while early Thursday’s trading is in red.

Fresh easing probes through hourly cloud base (108.59) and looks for further bearish signal on break.

Negative momentum is building, with downside pressure reinforced by 10/20SMA bears-cross, which is forming on daily chart.

On the other side, converged 55/100SMA’s are attempting to form bull-cross at, which supports along with Fibo support at 108.01 (50% retracement of 104.63/111.39 rally).

Overall structure is bearish and favors further weakness with extended upticks to hold below 30SMA (109.50) and keep bears in play.

Res: 109.07; 109.50; 109.74; 110.00

Sup: 108.53; 108.34; 108.11; 108.00