USDJPY regains traction after Friday’s fall

USDJPY edged up in early Monday, recovering a part of Friday’s around 1% drop, sparked by dovish comments from Fed Chair Powell.

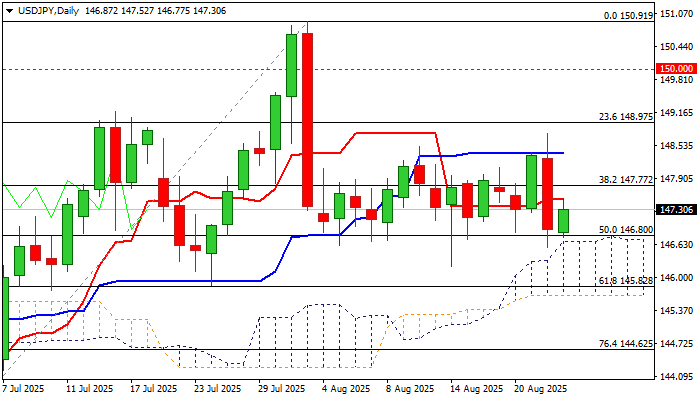

Friday’s fall was contained by rising 55DMA (146.60) which tracks the pair’s ascend since early July, as well as by the top of ascending daily Ichimoku cloud (spanned between 146.70 and 145.64).

The price returned to the range (146.21/148.77), where it is held for the fourth consecutive week, but the downside is expected to remain vulnerable (despite strong supports) as long as the price stays on the lower side of the range and while capped by daily Tenkan-sen (147.50).

Technical picture on daily chart is mixed (daily Tenkan/Kijun-sen in bearish setup / 14-d momentum broke into negative territory vs rising daily cloud / 55DMA), with markets awaiting stronger direction signals.

Focus will be on release of US PCE (due on Friday) which will provide more details about inflation, and next week’s releases of US labor reports, both expected to contribute to Fed’s decision on September’s policy meeting.

Expect initial bullish signal on firm break of daily Tenkan-sen, with rise through daily Kijun-sen (148.38) to bring bulls fully in play and bring psychological 150 barrier in focus.

Conversely, violation of cloud top / 55DMA would weaken near-term structure and generate initial signal of bearish continuation of larger downtrend from 150.91 (Aug 1 peak).

Res: 147.50; 147.80; 148.38; 148.77

Sup: 146.70; 146.21; 145.82; 145.64