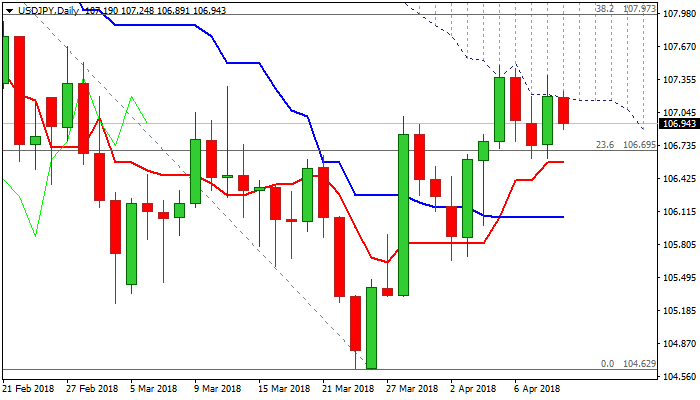

USDJPY – thick daily cloud continues to cap and keep the risk of reversal; upbeat US CPI data could provide strong bullish signal

Thick daily cloud continues to limit recovery leg from 104.63 for the fifth consecutive day, with growing risk of stall, as bulls failed to close above cloud base in four consecutive attempts.

loud is spanned between 107.18 and 109.34 and continues to heavily weigh, as Tuesday spike into cloud (daily high was at 107.40) was short-lived and mainly offset by today’s action which so far holds in red.

Initial warning signals come from south-turning daily RSI and sideways-moving 10SMA, while slow stochastic continues to trend lower after reversal from overbought territory on Monday.

Immediate outlook is expected to remain negative while recent highs at 107/40/50 stay intact.

The pair eyes US CPI data for fresh signal, with upbeat results needed to spark fresh action higher for eventual break and close within daily cloud.

Conversely, disappointing US inflation numbers could be a catalyst for fresh weakness and signal formation of lower base.

Close below 10SMA (106.71) would be initial negative signal, which needs confirmation on extension and close below converged 20/30SMA’s (106.27).

Res: 107.10; 107.18; 107.50; 107.97

Sup: 106.71; 106.60; 106.27; 106.00