USDTRY eases after repeated upside failure; CBRT rate decision on Wednesday is highly anticipated

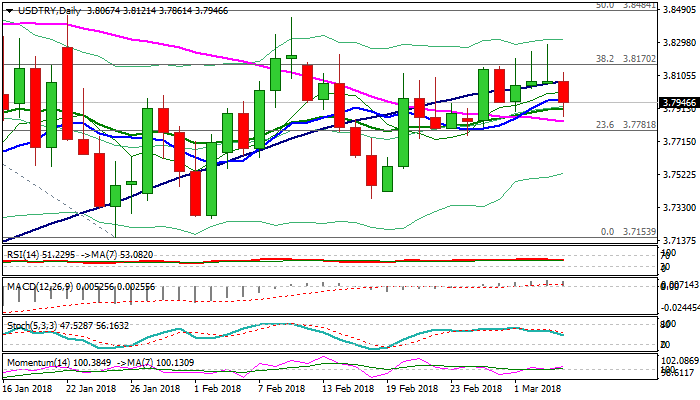

The pair dipped to one-week low at 3.7861 on Tuesday, following repeated strong upside rejections on Fri/Mon and Monday’s Gravestone Doji which signaled stall of recovery leg from 3.7153 (25 Jan low) and reversal.

Upleg from 3.7380 (16 Feb trough) faced strong headwinds at Fibo 38.2% of 3.9814/3.7153 descend barrier at 3.8170, after several probes higher failed.

Fresh easing was so far contained by daily Kijun-sen (3.7856) which guards daily cloud base at 3.7806, where dips should find footstep to keep overall bullish structure in play.

Focus turns towards tomorrow’s CBRT interest rate decision. The central bank is expected to keep interest rates unchanged, maintaining the policy for quite some time.

Such decision, when the central bank would repeatedly ignore double-digit inflation at levels twice as its target, would put lira under fresh pressure.

Test of target at 4.00 would become more likely in scenario when high inflation requires higher interest rates but central bank doesn’t react on President Erdogan’s call to lower rates in order to boost the economy.

Fresh weakness of Lira will look for pivotal points at 3.8450 and 3.88 to open way towards record high at 3.9814 and eventual push towards psychological 4.00 target.

Res: 3.8000; 3.8121; 3.8283; 3.8450

Sup: 3.7924; 3.7856; 3.7806; 3.7725