USDTRY – post-CBRT bearish acceleration is running out of steam; focus turns to Fed

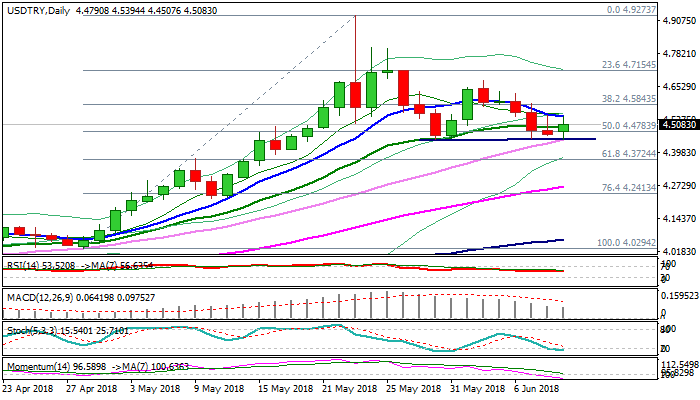

The USDTRY pair moved higher on Monday after post-CBRT weakness found just above previous low at 1.4473 (30 May) and was contained by rising 30SMA (4.4503) today.

Positive impact on CBRT rate hike last week was so far limited as the pair failed to break key support at 4.4473, while data released today, pushed lira lower.

Turkish GDP data showed the economy grew 7.4% in Q1, slightly better than previous figure at 7.3%, but wider trade gap (5.42 B vs 4.81B in Mar) soured lira’s sentiment.

Conflicting techs keep the pair without clear direction today, as Friday’s inverted Hammer and today’s bounce, signal reversal.

On the other side, growing bearish momentum remains supportive for lira.

Firm break below 4.4473 pivot would open way for extension towards 4.3724 (Fibo 61.8% of 4.0294/4.9273 rally.

Conversely, extension and close above initial barrier at 4.5376 (10SMA) would provide bullish signal for extended recovery and ease existing bearish pressure.

Near term focus turns towards Fed’s rate decision on Wednesday which is eyed for fresh direction signal.

Res: 4.5376; 4.5873; 4.6280; 4.6782

Sup: 4.4503; 4.4473; 4.4000; 4.3724