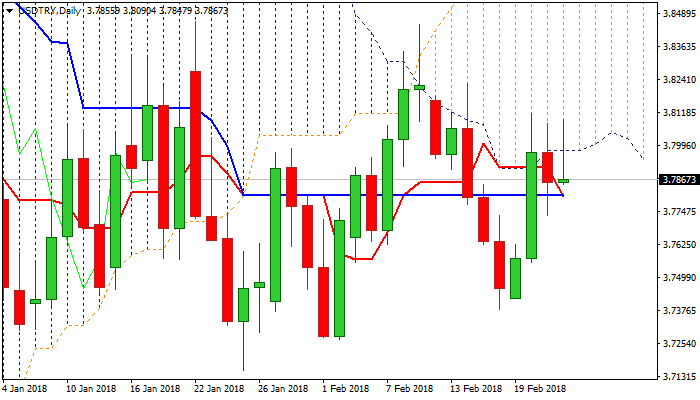

USDTRY- thick daily cloud continues to cap recovery attempts

Recovery rally from 3.7380 (16 Feb low) shows strong signs of stall as thick daily cloud (cloud base lies at 3.7974) continues to cap (brief probes in past couple of sessions through cloud base were short-lived). Repeated strong upside rejections form the third consecutive daily candle with long upper shadow, signaling that bulls might be running out of steam.

Daily Ichimoku studies are turning to bearish setup and keeping the downside vulnerable, with 14-d momentum turning south and threatening of break into negative territory.

Today’s action was so far contained by 10SMA (3.7842, also near Fibo 38.2% of 3.7809/3.8114 upleg), with sideways-moving 20SMA reinforcing support (3.7809).

Firm break below these supports would generate stronger bearish signal for reversal and also leave a triple-top on daily chart.

Bearish scenario includes acceleration through Wednesday’s spike low at 3.7731 and attack at next pivotal support at 3.7661 (Fibo 61.8% of 3.7809/3.8114) to confirm reversal on break.

Conversely, firm break through cloud base and lift above recent spikes at 3.81 zone would generate bullish signal and neutralize downside risk.

Res: 3.7974; 3.8075; 3.8115; 3.8170

Sup: 3.7842; 3.7809; 3.7747; 3.7661