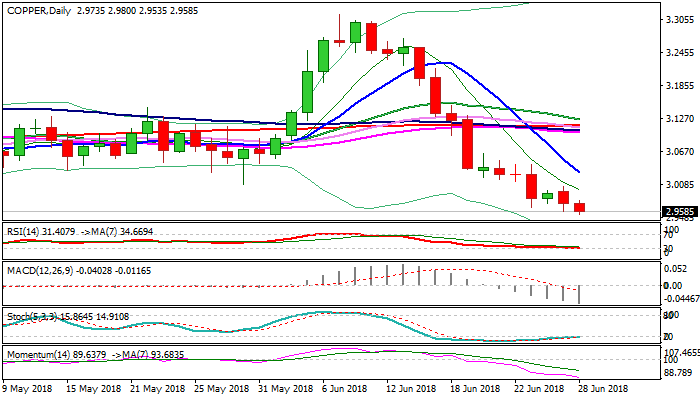

Violation of base at $2.94 zone could trigger further extension of downtrend from 2018 high

Copper hit new over three-month low at $2.9535 on Thursday, in extension of steep fall from 2018 high at $3.3140 (posted on 07 Jun) which lasts almost three weeks.

Bears so far show no signs of fatigue despite oversold conditions and pressure key supports at $2.94 zone (higher base consisting of 05 Dec low at $2.9425 and 26 Mar low at $2.9370).

Supports also mark the lower boundary of multi-month consolidation as larger uptrend from Jan 2016 low at $1.9360 ran out of steam.

Sustained break lower would spark further weakness on completion of double-top on weekly chart for extension towards next strong support at $2.8960 (weekly cloud base).

Falling 10SMA continues to track descend (currently at $3.0292) and marks solid resistance which is expected to limit upticks and guard a cluster of MA barriers which lays in $3.1013/$3.1255 zone.

Res: 2.9800; 3.0000; 3.0292; 3.0645

Sup: 2.9535; 2.9435; 2.9370; 2.8960