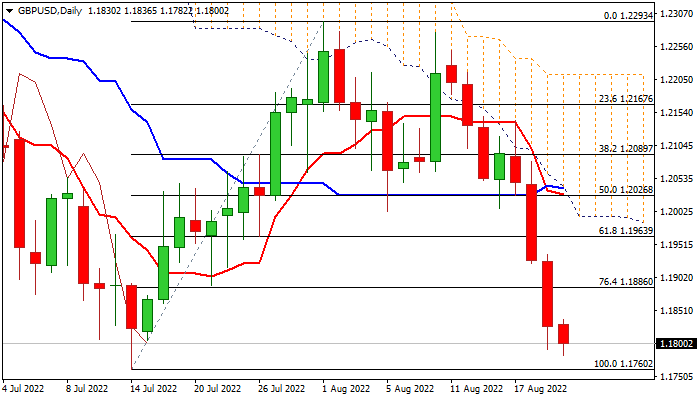

Violation of key 1.1760 support to risk test of pandemic low at 1.1410

Cable remains firmly in red for the fourth straight day and hits five-week low on probe through 1.18 handle in European trading on Monday.

Bears look for retest of 2022 low at 1.1760, break of which would risk fresh extension towards pandemic low at 1.1410 (Mar 2020).

Firmly bearish techs on daily and weekly chart add weak to sentiment on negative fundamentals and darkened economic outlook, though bears may struggle to clear 1.1760 pivot, as daily studies are oversold.

Consolidation should be ideally capped by broken Fibo 76.4% at 1.1886, with stronger bounce to stall under pivotal 1.20 resistance zone (psychological / base of thick daily cloud) and keep bears in play.

Res: 1.1836; 1.1886; 1.1963; 1.2000

Sup: 1.1782; 1.1760; 1.1700; 1.1634