Bulls are taking a breather after last week’s 2.6% rally

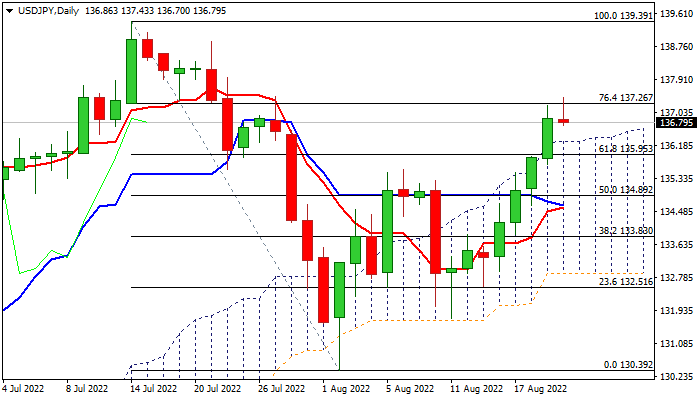

Bulls are consolidating at pivotal Fibo barrier at 137.26 (76.4% of 139.39/130.39 corrective leg) following last week’s 2.6% advance (the biggest weekly advance since the last week of May).

Dollar remains firm in risk aversion environment and looks for retest of 2022 high (139.39, posted on July 14), with shallow consolidation likely to precede final push towards 139.39 target.

Bullish daily studies support the notion, with last Friday’s break and close above thick ascending daily cloud and weekly bullish engulfing pattern, adding to positive signals.

Dips should be ideally contained by cloud top (136.30) and broken Fibo 61.8% (135.95) to keep bulls in play.

Res: 137.43; 137.95; 138.87; 139.39

Sup: 136.30; 135.93; 135.36; 134.89