Weak inflation data pressure pound after thin daily cloud capped recovery

Cable stands at the back foot on Wednesday and accelerated lower after data showed Britain’s inflation fell sharply in April, hitting the lowest since 2016, due to coronavirus shutdown.

This also turns focus towards possible introducing negative interest rates and markets will closely watch speeches from top BoE officials, scheduled later today

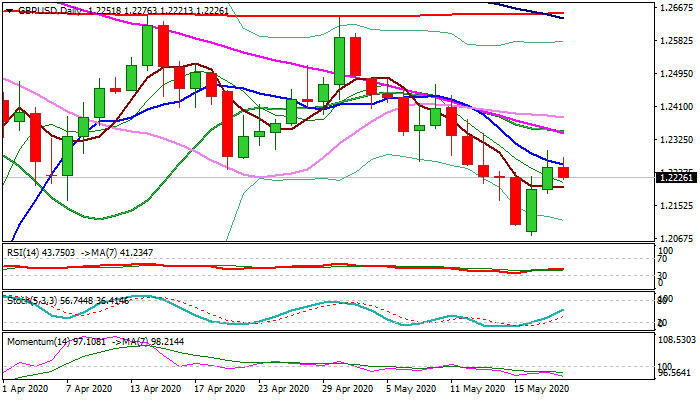

Two-day recovery from 1.2074 (two-month low) showed signs of stall on approach to thin daily cloud (bulls also failed to close above cracked 10DMA), with fresh pressure coming from negative data.

Daily cloud twists today but so far failing to attract, while rising bearish momentum and negative configuration of daily MA’s warn of further easing.

Initial supports lay at 1.2200 (5DMA) and 1.2184/74 (19 May low / Fibo 38.2% of 1.1409/1.2647), loss of which would unmask key level at 1.2074 (18 May) and risk attack at psychological 1.20 support.

Repeated close below falling 10DMA (1.2258) would signal that recovery ran out of steam and might be over.

Res: 1.2258; 1.2291; 1.2304; 1.2340

Sup: 1.2200; 1.2174; 1.2164; 1.2100