Weak sentiment on rate cut expectations keeps pound firmly in red

Cable remains in red in early Tuesday’s trading and extends weakness after strong fall on Monday, as downbeat GDP data showed UK economy grew at slowest pace in seven years in November that increased chances of rate cut in coming months.

Comments of a number of BoE policymakers who backed rate cut added to trader’s expectations of central bank’s action.

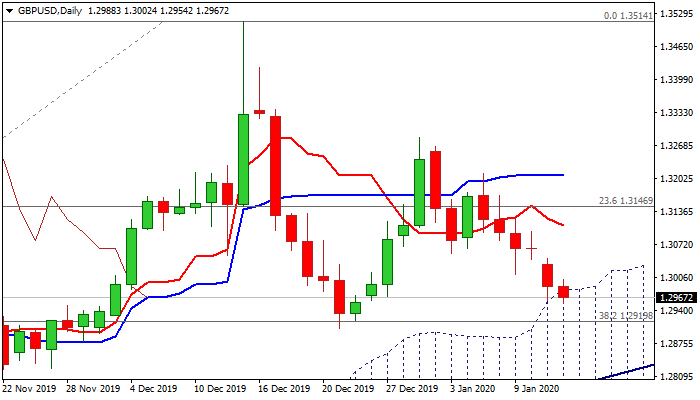

Monday’s close below psychological 1.30 support and today’s extension that penetrated rising thick daily cloud were negative signals.

Bears eye next pivotal supports at 1.2919/04 (Fibo 38.2% of 1.1958/1.3514 ascend / 23 Dec trough), break of which would spark fresh weakness on completion of failure swing pattern on daily chart and expose trendline support (1.2805).

On the other side, bears may face headwinds and stay on hold as daily momentum and RSI are flat, while stochastic is oversold.

Repeated close above daily cloud would support scenario, with corrective upticks expected to hold below daily Tenkan-sen (1.3110) and maintain bearish bias.

US inflation data are in focus today and expected to provide fresh direction signals.

Res: 1.2981; 1.3002; 1.3044; 1.3080

Sup: 1.2954; 1.2919; 1.2904; 1.2823