Weak UK retail sales would add to negative outlook and spark fresh weakness below 1.30

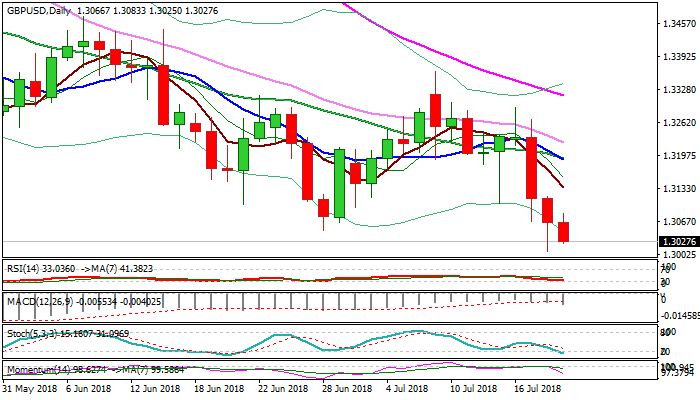

Cable came under pressure in late Asian / early European trading, after brief recovery from Wednesday’s new ten-month low at 1.3009, which stalled at 1.3083.

Pound was hit by weaker than expected UK inflation data on Wednesday and probed below key 1.3049 support (28 June low), but failed to close below it on the first attempt.

Fresh weakness today is focusing again psychological 1.30 support (also weekly cloud base), with strong bearish signal expected on close below.

Overall picture remains negative with Brexit concerns and weak inflation numbers which reduced hopes for August rate hike, adding to negative outlook.

Daily techs are in firm bearish setup but oversold conditions may delay final break lower and continuation of larger downtrend, which would open targets at 1.2905 (05 Sep 2017 low) and 1.2865 (Fibo 61.8% of 1.1930/1.4376 uptrend).

UK retail sales data are in focus today (Jun m/m 0.1% f/c vs 1.3% prev / core Jun m/m -0.3% f/c vs 1.3% prev), with weak outcome today expected to increase pressure on British pound.

Recovery top at 1.3083 marks initial resistance, followed by Wednesday’s high at 1.3118 and falling 5SMA at 1.3136, with stronger upticks to be capped by falling 10SMA (1.3189).

Res: 1.3083; 1.3118; 1.3136; 1.3189

Sup: 1.3009; 1.3000; 1.2905; 1.2865