Weaker dollar and rising inflation lift gold

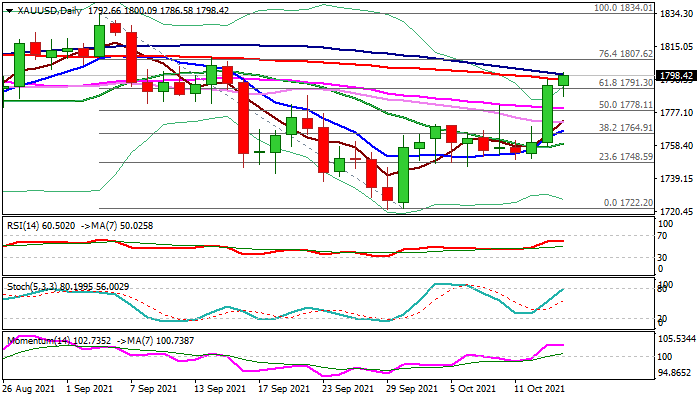

Spot gold rose sharply on Wednesday (up 1.82% for the day, the second biggest daily advance in 2021) lifted by weaker dollar on further rise in US inflation and unclear situation regarding the start of tapering stimulus, which markets widely expected to begin in Nov/Dec.

Fresh advance broke through 200DMA ($1796) and hit one-month high, pressuring psychological $1800 barrier, break of which would generate fresh bullish signal for further advance.

Bullish daily studies support the near-term action which is currently riding on the third wave of five-wave cycle from $1721 (Sep 29 low).

Bulls extended above 100% of Fibonacci expansion that opens way towards targets at $1814 (FE 138.2%) and $1825 (FE 161.8%) in extension.

Thick daily cloud, above which the price emerged on Wednesday, underpins the action and cloud top ($1784) marks solid support, expected to keep the downside protected.

Res: 1800; 1808; 1814; 1820

Sup: 1791; 1786; 1784; 1779